Bitcoin whales are becoming more active over the last 24 hours. However, these actions may not be in favor of the top coin.

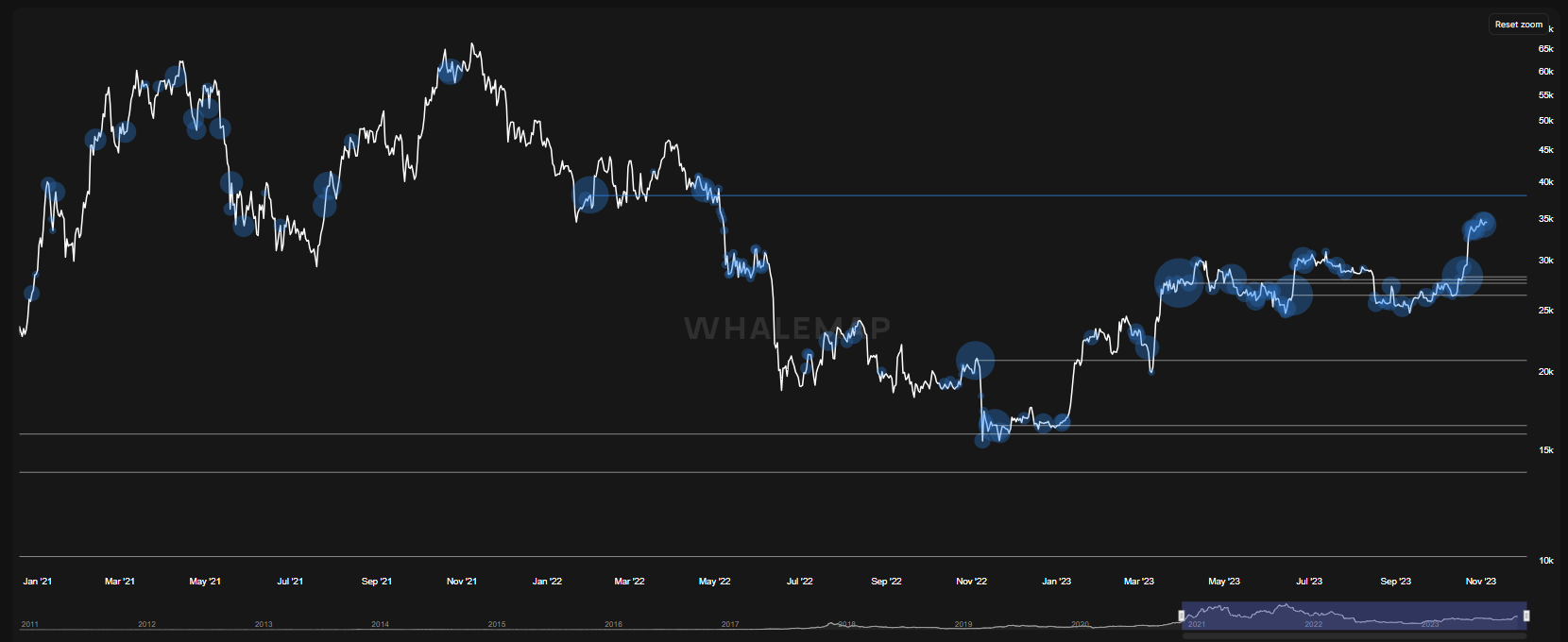

The chart above is one depicting the whale inflow to exchanges. With the lines showing the prices and the bubble signifying the influx, it is not hard to understand where BTC is heading. It is common knowledge that when there are notable entries into exchanges, there’s an impending selloff.

This is also an indication of present sellers at the time of writing. The impact on prices is one that cannot be over-emphasized. The apex coin is trading at $35,000 but peaked at $35,290 before dropping to a low of $34,766. The current candlestick is a doji which means bitcoin may end the current day with no significant change in value.

This is not the first time the coin is experiencing this kind of standstill. During the previous intraday session, it had more volatility as it attained a high and a deeper low. Nonetheless, the most recent trend of little to no significant change is having on the monthly, leading many to wonder what will happen in the coming days.

It is worth noting that there are events at the time of writing that may hint at how the asset may perform this month. For example, a few hours ago, a prominent crypto site reported that the number of wallets with less than $1000 has increased to $8 million. This is an indication that more retailers and smaller HODLers are stocking up on the asset in anticipation of more increases.

Unfortunately, the whales’ outflow is relatively low or non-existent at this time. With inflow outweighing the opposite, the BTC prospect is not one of the best. Nonetheless, November is one of the positive months.

Moonvember May be Upon Us

During the previous month, the coin gained more than 28%. This is in accordance with previous bullish predictions for October.

November is also another positive period for Bitcoin. On average, it gains 22% which is higher than the previous 30-day session. This could be an indication that BTC may perform better and break more key resistances. With this in mind, many may look forward to seeing the apex coin break $40k.

How High Will Bitcoin Go?

Key Support: $34k, $29k, 27k

Key Resistance: $36k, $40k

The chart above highlights several key levels to watch over the next twenty-four days. Going by bitcoin’s average in November, it is not hard to conclude it is going to be a bullish month regardless of its slow start.

One of the levels to watch is the $36k resistance. A few days ago, the coin tested this key but failed to break it. In the coming days, BTC may attempt the said mark again and flip. Afterward, it may try to test the $40k resistance. This may be far-fetched as more barriers may reveal themselves as the uptrend continues.

On the other hand, in the event of retracements, the $34k support is one of the first levels to watch. If it fails, bitcoin could go as low as $29k and $27k in severe cases.

Tags

Bitcoin (BTC)- Gary Gensler Criticizes FIT21 Act Ahead of Crucial House Vote

- 3 Must-Buy VR Coins Before They Go Mainstream – 5SCAPE Outshines DLUME and SGAZE

- Trump Campaign Accepts Crypto Donations, Aiming to Build ‘Crypto Army’

- Memecoin Investors Shift Interest to New VR Project Making Waves, Seeking 10x Returns

- The 10+ Best Crypto Market Makers in 2024

- Building Secure Blockchain Systems: An Exclusive Interview with ARPA and Bella Protocol CEO Felix Xu

- Building The “De-Facto Crypto Trading Terminal”: An Exclusive Interview with Aurox CEO Giorgi Khazaradze

- Building a New Global Financial System: An Exclusive Interview With Tyler Wallace, Analytics Head at TrustToken

- “Solana is the Promised Land for Blockchain” — An Exclusive Interview with Solend Founder Rooter

- El Salvador: Where The Bitcoin Revolution Begins With A Legal Tender

Why Trust Us

Why Trust Us