The Securities and Exchange Commission (SEC) of Nigeria is taking significant steps to ban peer-to-peer (P2P) crypto trading as part of a broader regulatory crackdown that includes ongoing legal actions against executives from the cryptocurrency exchange Binance. This move highlights the growing regulatory concerns over the impact of P2P trading on the Nigerian economy, particularly its effect on the national currency, the naira.

Concerns Over Currency Stability

Emomotimi Agama, the Director General of the SEC, has voiced substantial concerns about P2P trading, noting its potential to manipulate the exchange rate of the naira. In response, the SEC is considering measures to remove the naira from P2P platforms, which allow users to trade cryptocurrencies directly with each other, bypassing traditional financial intermediaries.

This direct trading method has raised alarms among Nigerian regulators, who view it as a potential threat to the financial stability of the country.

Allegations and Legal Actions

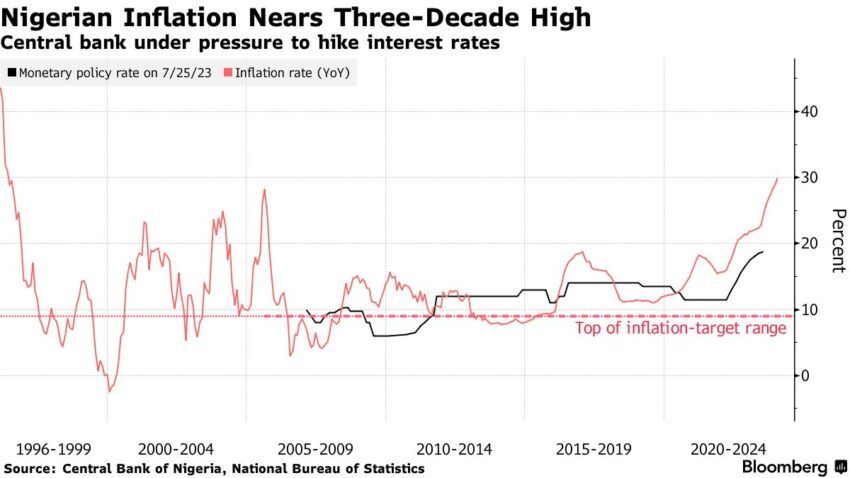

The urgency of these regulatory measures is underscored by recent allegations against Binance and other cryptocurrency exchanges. Nigerian officials have accused these platforms of setting dollar prices that do not correspond to the naira’s value as determined by the Central Bank of Nigeria. This discrepancy has led to speculative trading practices where the prices on crypto exchanges are used as benchmarks for foreign exchange trading. This issue is particularly concerning given Nigeria’s ongoing battle with inflation and economic instability.

Amid these regulatory efforts, the SEC’s actions have extended to a ban on Binance operations within Nigeria and the detention of its top executives. Tigran Gambaryan, one of the detained executives, was arrested in Abuja and faces charges including tax evasion and money laundering. He is set to go on trial this month. Nadeem Anjarwalla, another executive, managed to flee the country.

Binance’s Response to the Crackdown

In light of these developments, Richard Teng, CEO of Binance, has publicly demanded Gambaryan’s release. On May 7, Teng issued an open letter criticizing the Nigerian authorities for setting a “dangerous precedent” with their actions, which he believes could adversely affect global corporate engagements in the country. Teng defended Gambaryan, highlighting his role as a functional expert in financial crime, not a decision-maker or negotiator in Nigeria.

This isn’t the first instance where Binance has sought to address the legal challenges faced by its executives. In early April 2024, the company issued a statement pleading for the non-responsibility of Gambaryan amid ongoing discussions with Nigerian officials.

Future of Crypto Regulations in Nigeria

As the legal saga continues to unfold, the trial of Binance and its executives, originally set for earlier proceedings, has been adjourned to May 17. This delay is indicative of the complexities and legal intricacies involved in the case, which centers around charges of money laundering and conducting unauthorized financial activities. The adjournment adds to the prolonged atmosphere of uncertainty surrounding the operations of cryptocurrency firms in Nigeria, particularly those of Binance, which has faced significant scrutiny from Nigerian authorities.

As the trial date approaches, the outcomes could have significant implications not only for Binance but also for the regulatory landscape of cryptocurrency trading in Nigeria and potentially beyond.

Why Trust Us

Why Trust Us