Investment giant BlackRock has emerged as the top gainer for this week’s trading of the spot Bitcoin exchange-traded fund (ETF) as it accounts for 34,316 BTC (worth more than $2.1 billion) that flowed into the financial product throughout the week.

BlackRock Sees Highest Inflow

BlackRock’s iShares Bitcoin Trust (IBIT) was among a cohort of spot Bitcoin ETF products which were endorsed by the United States Securities and Exchange Commission (SEC). As trading kicked off, IBIT soon claimed the second-largest market share behind Grayscale’s GBTC. However, with the steady outflows seen on Grayscale, BlackRock has garnered the most attention from investors.

This week, the IBIT product saw the most inflow on February 29th, totalling 10,140 BTC. This increased engagement coincided with the same day BlackRock revealed its expansion into Brazil. Through the Brazilian Depository Receipt (BDR), the investment company launched a Brazilian variant of its IBIT product under the ticker – IBIT39. The Brazilian stock exchange company B3 serves as a partner to facilitate the Bitcoin ETF product trading.

Grayscale admittedly has the largest portfolio of BTC despite its continuous outflows. Current data shows that it holds 438,209 BTC even though investors sold over 180,900 BTC since January 10th. The huge loss has positioned Grayscale as the top loser in the spot Bitcoin ETF frenzy.

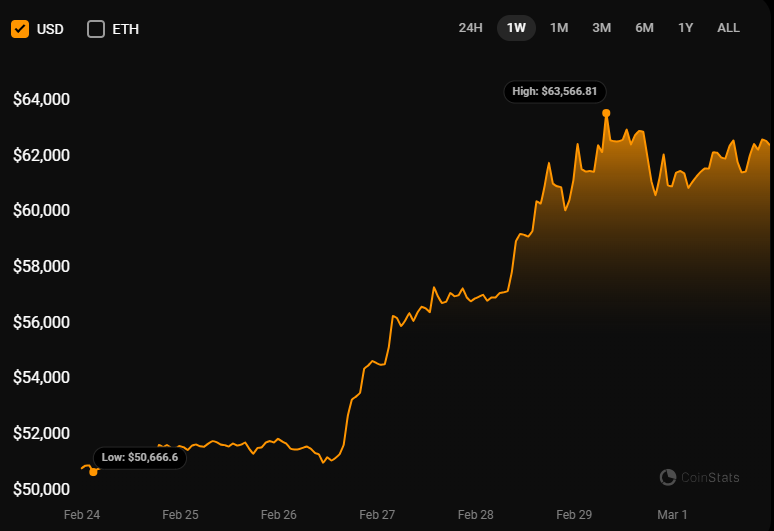

BTC Breaks $62k

This week was a memorable one for the entire Bitcoin community. With BTC price soaring to as high as $63,500, investors deduce that the leading crypto asset may attain and potentially surpass its current all-time high (ATH) of about $69,000, ahead of the halving event. The steady purchases of the spot Bitcoin ETF have been a driving force for BTC’s price increases.

It is worth noting that BTC traded at $50,600 at the start of this week. At the time of writing, however, BTC traded at $62,300, representing a 2.3% increase in the last 24 hours and a 22% uptick over the past week.

Source: CoinStats