Bitcoin partly owes its recent price surges to institutional investors who have poured in $86 billion in the past six months.

Bitcoin has grown from being a peer-to-peer currency into a prominent investment asset. The digital coin has captured the interest of retail and institutional investors alike. Recent data confirms that institutional clients have invested $86 billion in BTC within the past six months. This cash inflow has fueled Bitcoin’s recent bull run to new heights.

Bitcoin ETFs Drive the Surge

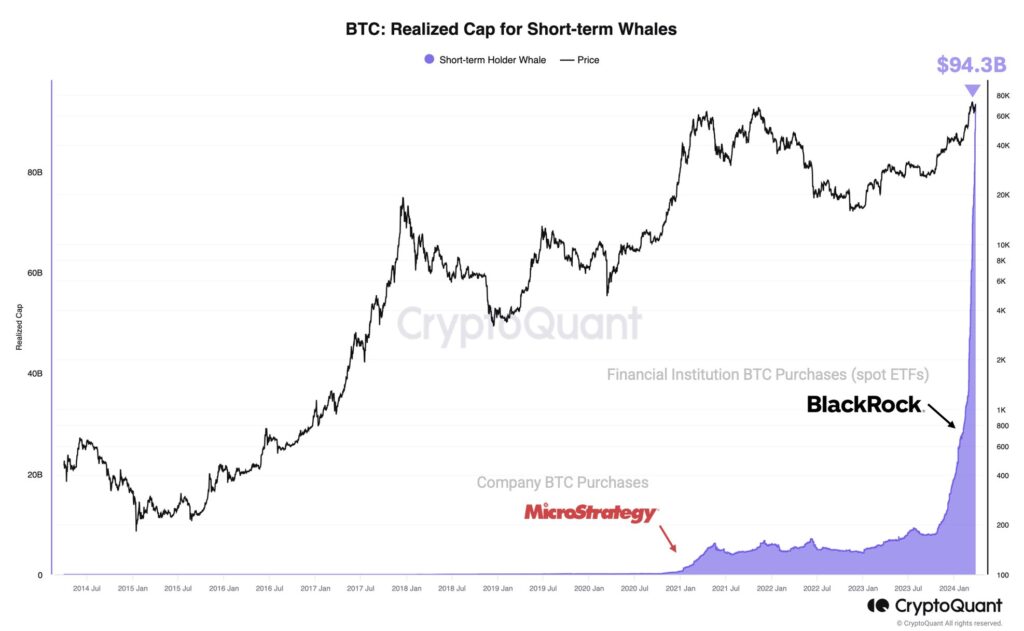

According to a chart from the on-chain analytical platform CryptoQuant, a significant institutional adoption of Bitcoin began in late 2020. At the time, the business intelligence company MicroStrategy became the first publicly traded firm to accumulate BTC as an investment scheme. Under the leadership of its co-founder Michael Saylor, the firm remained committed to acquiring as much BTC as possible. Today, the company holds about 1% of Bitcoin’s total supply of 21 million coins.

As seen in the chart above, a significant surge began in late 2023. Several investment management companies were gearing up to begin offering the spot Bitcoin exchange-traded fund (ETF) in the United States. Offering the financial product mandated these firms to accumulate actual BTC on investors’ behalf. Immediately after the approval, these Bitcoin ETFs began soaking up billions of dollars from investors.

Prominent among these companies was the investment giant BlackRock which offered its iShares Bitcoin Trust (IBIT). The company once saw an inflow worth nearly a billion dollars in a single day.

Currently, the spot Bitcoin ETFs have skyrocketed to a $50 billion market in less than three months.

Impact on BTC’s Price

Interestingly, the increased engagement with the ETF products contributed to Bitcoin’s recent surge to its current all-time high (ATH) of $73,800. Although the asset dropped to around $63,000, it has regained a trading price of $70,200.

Market experts project that an adoption of Bitcoin ETFs among brokerage companies and Registered Investment Advisor (RIA) firms will drive more engagement with the underlying crypto asset.