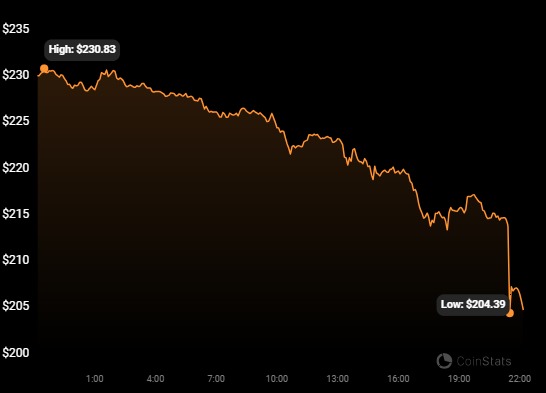

Bitcoin cash is experiencing one of its biggest losses. As a result, it is one of the top losers over the last 23 hours. Data from Coinstats showed that the token saw a gradual decline in value from earlier today. However, the downtrend got worse a few hours ago.

Breaking the charts to a 2-hour timeframe, the massive retracement took place at 20:00 (UTC). BCH price was at $214 when the candle started. However, it retraced to a low of $200 in its attempts to flip the $200 support. It rebounded and closed that session $206 which indicates a more than 4% loss in the end.

This marks the asset’s tenth day with no significant increase in value. Nonetheless, during the previous intraday session, it tried breaking above $240 but failed as it faced strong rejections at $236. Afterward, it dropped to a close at $228 which was a little lower than its opening price.

Following the most recent trial at the $200 support, many wonder if an uptrend is at hand. Here is a signs that may confirm it.

Bitcoin Cash is Due For a Rebound

Due to the massive decline in value, BCH is in a lot of movement with indicators. For example, before now, the Moving Average Convergence Divergence was negative. It displayed a bearish divergence as the 12-day EMA intercepted a 26-day EMA. At the time of writing, the bearish reading is still present. This may spread more fear of further downtrends.

While this may take place, the relative strength index is hinting at a reversal in market trends. Currently at 32 further decline in value may send the metric below 30. This will mean that the altcoin is oversold. As per the rules governing RSI, this could also indicate an impending of trend.

It is also worth noting that this prediction may take effect within the next two weeks. However, on the long-term scale, BCH may experience more downtrends. A look at the moving averages confirms the statement. The 50-day MA has stopped its uptrend and is slightly curved downwards. This may translate to the start of what may lead to a death cross.

Key Levels to Watch

Vital Resistance: $240, $260, $300

Vital Support: $200, $180, $100

The first resistance to watch closely is the $240 barrier. Following a failed attempt at the mark during the previous intraday session, BCH is more likely to retest it coming days. It is worth noting that it is one of the toughest to crack as previous price movements suggest. However, it performs better as a support and may hold out after it flips.

The asset may go as high as $300, depending on the strength of the bullish momentum. Nonetheless, bitcoin cash may test $200 if the current trend continues. Based on previous attempts at the mark, there is a strong indication it may break. if this happens, it may edge closer to $180. Breaking this barrier may be more damaging to the bulls as it may send the altcoin as low as $100.

However, the likelihood of this happening is slim. This is a result of the absence of any strong barrier after $180.