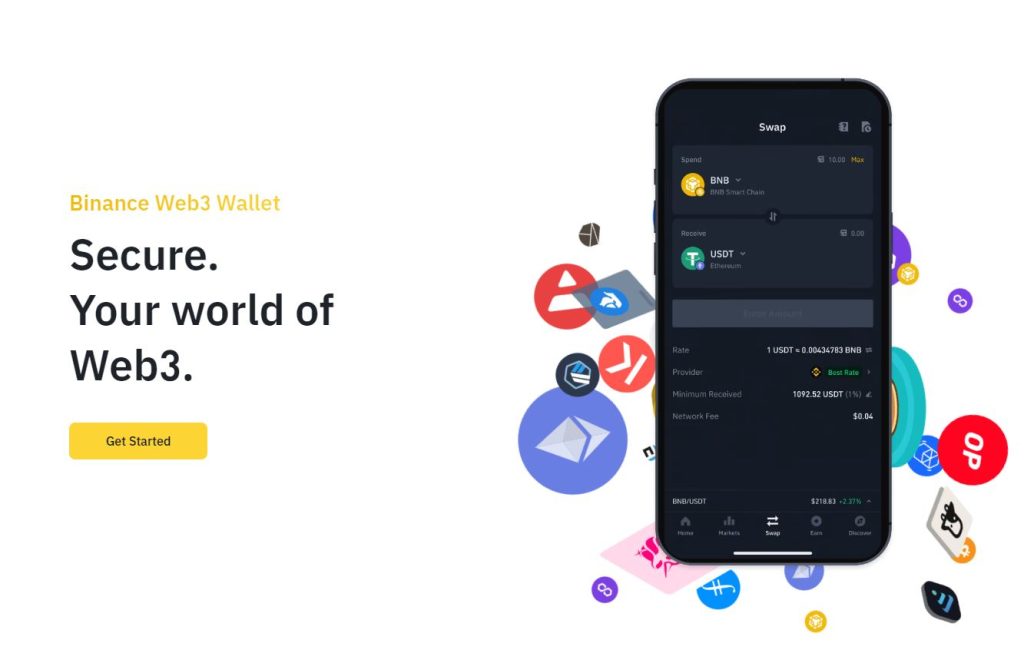

Crypto exchange Binance is expanding its Web3 wallet’s capabilities by integrating Bitcoin ARC-20 atomical assets through its Inscriptions Marketplace.

ARC-20 is a token standard, similar to Ethereum’s ERC-20, that allows for the creation and transfer of fungible tokens directly on the Bitcoin blockchain. To celebrate this integration, Binance is offering zero-fee trading on ARC-20 tokens until June 2nd, 2024.

This Move Comes Just Months After The Launch Of The Atomicals Protocol In January

Inspired by Ethereum’s ERC-20 standard, Atomicals enables the minting, transferring, and updating of non-fungible tokens (NFTs) on the Bitcoin network. Notably, these Atomicals remain lightweight, requiring only about 2.5 MB of data even after numerous updates or transfers. This efficiency allows any client, wallet, or service to easily verify the authenticity of an Atomical.

Beyond NFTs, Bitcoin Atomicals hold promise for various applications, including web hosting, file storage, atomic swaps, real-world asset tokenization, and decentralized social media. This update to Binance Wallet on May 2nd also included support for BEVM, a decentralized layer-2 solution compatible with the Ethereum Virtual Machine (EVM) and built on Bitcoin’s Taproot technology. BEVM utilizes Bitcoin itself as gas fees for smart contract execution.

Binance’s Move Reflects A Growing Trend Of Exchange Support For ARC-20 Assets

In February, Bitget announced compatibility with Bitcoin Atomicals through its native wallet, and OKX has established a dedicated marketplace for these assets.

Despite initial concerns about Bitcoin becoming obsolete compared to smart contract-enabled blockchains like Ethereum and Solana, the past year has witnessed a surge of innovation in the Bitcoin network. Protocols like Ordinals, Inscriptions, Runes, and now Atomicals demonstrate Bitcoin’s ability to adapt and embrace new technologies.

Further evidence of this evolution comes from Orders Exchange. Last quarter, they integrated the Bitcoin Runes protocol, enabling the issuance of fungible tokens on the Bitcoin network. They also constructed a bridge with MicroVisionChain, facilitating swaps between BRC-20 tokens and Bitcoin’s native tokens.

Meanwhile, the omnichain yield-generating protocol SolvBTC has garnered significant traction, accumulating a total value locked of $700 million. SolvBTC offers yield-bearing Bitcoin minted on various blockchains like Arbitrum, Merlin, and BNB Smart Chain. The protocol estimates potential annual returns of 5% to 10% on users’ Bitcoin deposits.