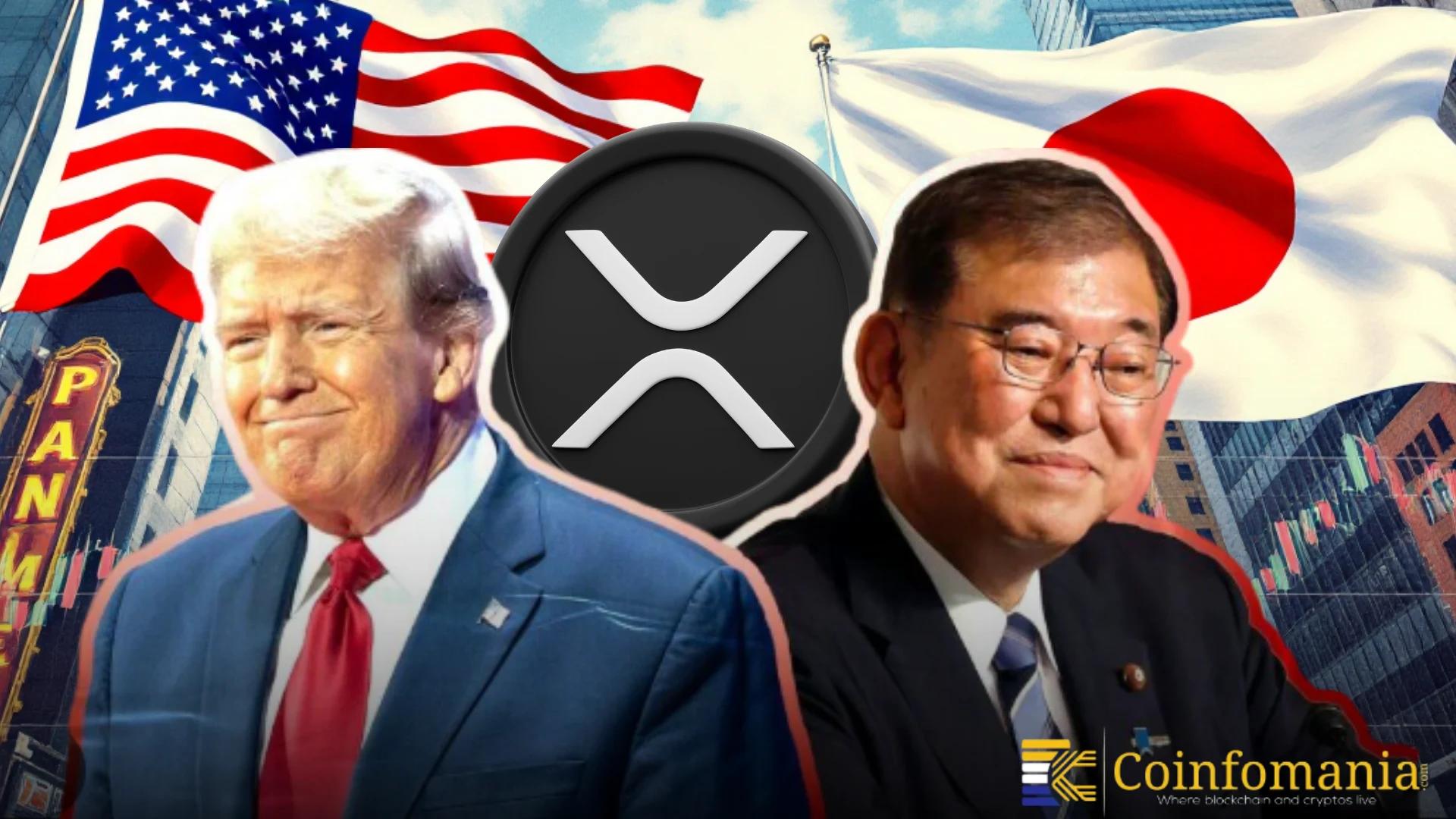

Trump Confirms $550B Investment from Japan as XRP Rises

Trump announces Japan’s $550B investment in the U.S. as Japan leads XRP adoption through RippleNet integration.

Quick Take

Summary is AI generated, newsroom reviewed.

Trump confirmed a $550 billion Japanese investment into the U.S. economy.

Japan expands trade cooperation through energy, technology, and manufacturing.

80% of Japanese banks integrate Ripple’s XRP for cross-border payments.

Ripple gains momentum as Japan leads blockchain innovation.

The previous president of the United States, Donald Trump, declared that Japan will make an investment of 550 billion in the country. He said this in one of his diplomatic speeches, which underlines the fact that this investment is enhancing trade and industrial relations between the two countries. According to Trump, the agreement was a giant leap into broadening of mutual development and enlarging of industrial cooperation. He pointed out that both countries will benefit through this alliance since they will increase their trade, technology, and employment.

🚨BREAKING: Trump just confirmed $550 BILLION coming from Japan. 🇯🇵🇺🇸

— John Squire (@TheCryptoSquire) October 29, 2025

And guess which country is leading the #XRP revolution? 👀

💥Japan. All in. #Ripple 💥 pic.twitter.com/VkuGZ6Zdrj

Japan Strengthens Economic Partnership with U.S

The announcement comes after Trump had met the Japanese Prime Minister, Sanae Takaichi. Japanese companies made several agreements with America nuclear energy, technology and manufacturing projects during the summit pledging approximately 490 billion to the American companies including Westinghouse and GE Vernova. Other investments will be in automotive and agricultural areas. The new deal enriches the golden era of the U.S. and Japan alliance and enhances the XRP economic stability in the case of economic trade tension around the world.

The pact between the U.S and Japan on investment brings in the use of reduced tariff on Japanese imports such as the automotive products exported to the U.S and increasing the U.S market access to the Japanese agricultural products as well as energy. Trump pointed out that Japan, which was traditionally closed market, opens itself to U.S. imported cars, rice, and meat. The purpose of this deal is to boost American exports and create new opportunities to the U.S. industries. Analysts believe that this relationship will boost economic recovery especially in nuclear power, clean manufacturing, and digital innovation.

Japan Time ahead in XRP and Ripple Adoption

Japan is still the first country to embrace the use of Ripple blockchain technology and token, XRP. More than 80 percent of Japanese banks are currently or intend to incorporate RippleNet to make cross-border payments. Yoshitaka Kitao, SBI Holdings CEO, verified the fact that large financial institutions in Japan actively implement XRP in order to enhance the efficiency of the transaction. XRP allows almost instant low-cost transfers between banks and puts Japan in the lead in blockchain-based finance.

Ripple specializes in remittances to international and corporate payments. The company partners with the financial centers of Asia and Japan is the most accommodating country. RippleNet enables the banks to transact business within few seconds with XRP as a bridge currency. The continued relations that ripple has been engaging in Asia is in line with the objective of Japan to digitalize its financial systems and keep up with the global competitiveness. Indirectly, the Ripple ecosystem can be strengthened by the investment of 550 billion by Japan as it will encourage more institutions to consider the blockchain to achieve faster global settlements.

Economic Experts Weigh In

Economists emphasize that the reason why Japan invests so much is that it shows the change in power relations in the world. They feel that the alliance would strengthen the Western collaboration in trade, and diminish reliance on the Chinese markets. According to market experts, improved U.S.-Japan relations may be beneficial to crypto markets, particularly in such tokens as XRP, because it would increase trust in the digital finance infrastructure. Nevertheless, analysts warn investors to dissociate politically related announcements with crypto hype.

With the announcement made by Trump, investors shifted their focus on XRP and its associated assets. The trading volume of XRP rose in Asia when traders were speculating on possible adoption benefits. At the same time U.S. stocks associated with energy and industrial manufacturing went on a roll. Ripple effect of the $550 billion commitment is predicted to be experienced over a number of years, gradually changing financial, energy, and blockchain ecosystems.

References

Follow us on Google News

Get the latest crypto insights and updates.