Bitcoin Whales and Falling Dormant Supply Signal Possible Reversal

Whales logged $1.24B in realized losses as short-term capitulation met profit-taking in late June. Active coin supply also plunged 17%.

Quick Take

Summary is AI generated, newsroom reviewed.

New whales realized over $641M in profits and $1.24B in losses in late June, suggesting a possible local market pivot.

On-chain activity dropped sharply, with active supply declining 17% over 30 days - a level that preceded rallies in the past.

Whale behavior and H1 portfolio rebalancing hint at a potential inflection point; eyes now on ETF flows and short-term demand recovery.

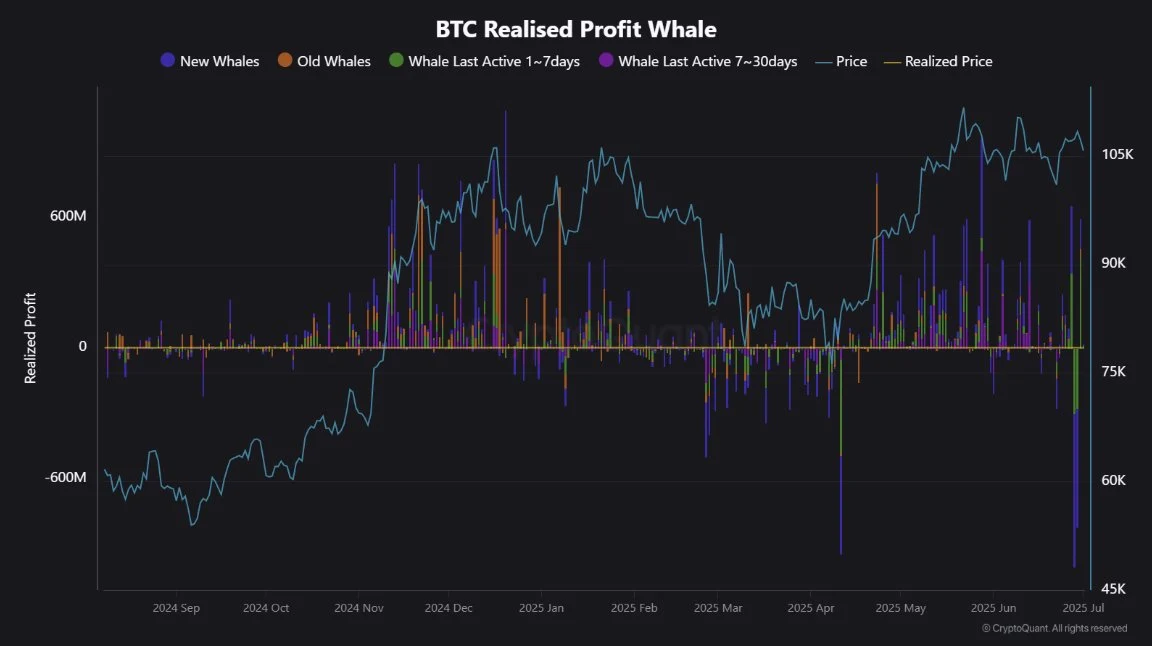

The final days of June saw a dramatic shift in Bitcoin on-chain behavior, with whales showing signs of internal conflict between capitulation and profit-taking. According to CryptoQuant analyst @KriptoMevsimi, new whales realized over $641 million in profits while simultaneously realizing more than $1.24 billion in losses. This rare overlap typically reflects extreme stress or rebalancing phases, where some players exit positions at a loss, while others take profit before a potential reset.

Interestingly, older whales remained mostly calm, with just $91 million in realized profits and minimal losses. This contrast suggests that long-term holders are not yet shaken, and the most reactive behavior is coming from newer entrants or funds repositioning ahead of Q3.

Why Late June May Have Been a Local Bottom

Historically, spikes in realized losses, especially from short-term holders, have occurred near local bottoms. That’s because panic selling and capitulation often precede accumulation phases by more experienced investors. What makes this recent behavior noteworthy is that the intense flow of profit-taking and losses did not continue into early July. Instead, on-chain flows have cooled, possibly indicating a momentary rebalancing or market exhaustion.

Chart 1 – BTC Realised Profit Whale Source: CryptoQuant

Late June marked the close of H1, a traditional rebalancing window for ETFs and large funds. This aligns with the idea that the unusual whale activity wasn’t just emotional; it may have been structural. Institutional managers could have used the downturn to clean up portfolios, lock in profits, or offset capital gains before Q3 begins.

Active Supply Plunges 17% – Does That Signal a Calm Before the Storm?

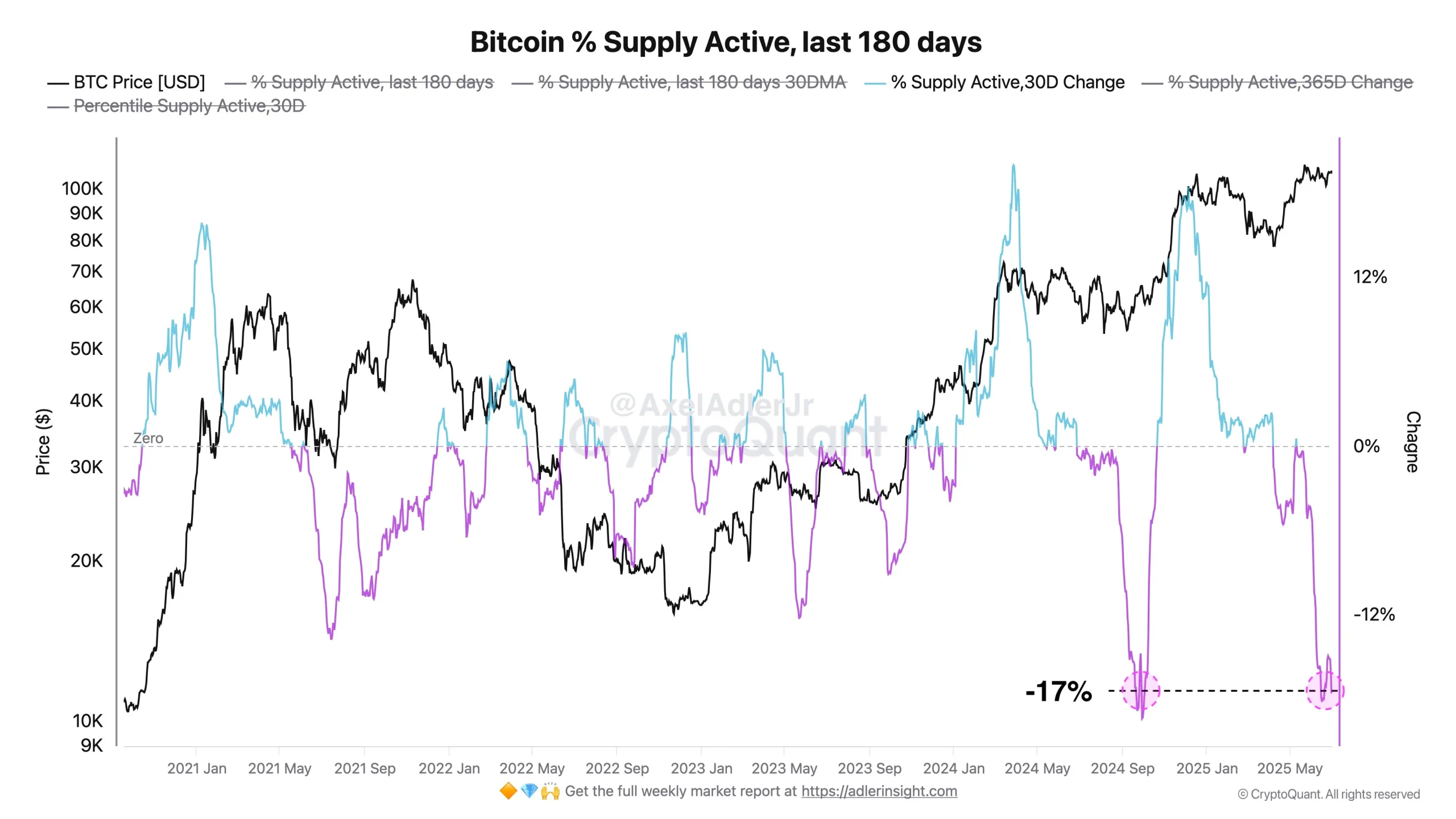

Backing up this thesis is another signal from on-chain analyst Axel Adler Jr, who highlighted a steep 17% drop in the 30-day change of active Bitcoin supply. This metric tracks how much of the total BTC supply moved in the last six months compared to a month ago and acts as a pulse for blockchain activity. To put it simply, fewer coins are moving. According to Adler, this level of inactivity was last seen in September 2024, right before Bitcoin kicked off a major rally.

Chart 2 – Bitcoin % Supply Active, last 180 days Source: Axel Adler Jr X Post on July 2, 2025

While low activity might seem bearish at first glance, it’s often a sign of supply exhaustion. If sellers are done dumping and buyers are waiting for confirmation, such lull periods can create tight liquidity conditions. That’s the kind of setup where any sharp demand return can trigger outsized price moves.

Sentiment Reset or Just a Breather?

When whales start to log billion-dollar losses and stop selling, and the network goes quiet all at once, there’s usually a bigger narrative playing out. Combine that with half-year rebalancing and the 17% drop in active supply, and you have the makings of a macro turning point.

Still, it’s not without risks. If macroeconomic conditions worsen or ETF inflows remain weak in early July, the market could test lower support zones. But for now, on-chain signals are whispering rather than shouting, with subtle hints that a pivot might already be in motion.

Trader’s Radar: Signals That Could Shift the Market

While no single metric guarantees direction, this convergence of realized losses, whale activity, and shrinking active supply creates a narrative worth tracking. If new supply remains dormant and long-term holders stay quiet, they could set the stage for accumulation. For now, the on-chain signals are flashing amber, not red. Traders would be wise to stay nimble, monitor post-H1 fund flows, and wait for clearer confirmation. Momentum might still be lurking beneath the surface; if the tide turns, it’ll likely start with the quiet moves of the smart money.

References

Follow us on Google News

Get the latest crypto insights and updates.