Bitcoin Struggles Below $108K as UTXO Supply Ratio and Geopolitical Tensions Impact Markets

Bitcoin struggles below $108K as UTXO Supply Ratio drops and geopolitical tensions intensify; key levels to watch for price direction.

Quick Take

Summary is AI generated, newsroom reviewed.

The UTXO Supply Ratio drop to 0.806 signals potential market pressure, with Bitcoin facing resistance below $108K.

Geopolitical tensions, including Israel’s attack on Iran, led to surging oil and gold prices, while Bitcoin saw $360M in long position liquidations.

Bitcoin’s critical support lies at $102K-$105K, with a potential breakdown below $100K indicating more selling pressure.

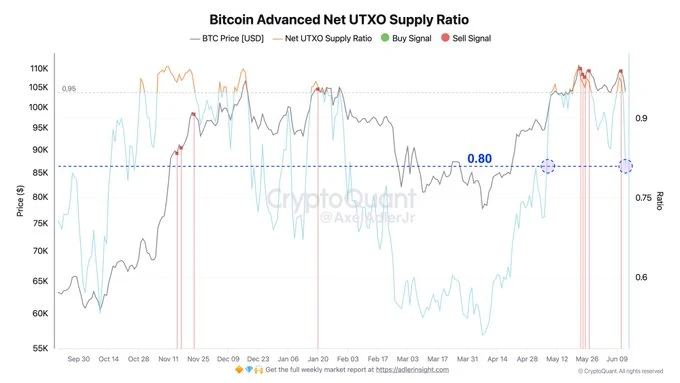

Axel Adler Jr. has highlighted the Advanced Net UTXO Supply Ratio which has fallen after a recent high of 0.96 on June 11 to circa 0.806 over the last 48 hours. UTXO (Unspent Transaction Output) Supply Ratio is an essential indicator that allows measuring the equilibrium between buyers and sellers on the market. A ratio of below 0.80 on the daily chart that holds is usually considered a “buy” signal and shows the development of a new micro-rally.

Conversely, should the ratio keep declining further and the price of Bitcoin decline under the level of $100K, the selling pressure in the market could further increase. UTXO ratio gives a significant sign about the possible price changes in the next days. That is why it is a significant indicator to follow by traders and investors waiting to see a potential change in the price trend of Bitcoin.

Market Overview: Geopolitical Tensions, Supply Disruptions, and Bitcoin’s Struggles

During the past day, the situation in the global markets was critical a number of times. To begin with, oil and gold surged due to demand in safe-haven assets by investors because of geopolitical tensions. This was mainly because of the increased fears of supply interruptions caused by the preemptive attack of Israel against Iran. Equities too acted in reaction to this development and additionally dragged the wider market mood.

Additionally, an interesting situation occurred in the crypto world: the long positions of Bitcoin were liquidated over night on major cryptocurrency exchanges to the amount of $360 million. These liquidations demonstrate how volatile the market is, particularly with Bitcoin finding difficulties in holding its support levels. The direction of Bitcoin is still an uncertainty with the Advanced Net UTXO Supply Ratio indicating a potential decline or prolonged volatility in the market.

Key Levels to Watch: $102K Support and $100K Break Point for Bitcoin

The latest behavior of Bitcoin indicates that it is in limbo. Bitcoin is currently ranging between $107K and $102K and is yet to find a good support as shown by the declining Advanced Net UTXO Supply Ratio. Provided that the ratio stays declining and the price of Bitcoin drops below the $100K mark, the cryptocurrency may remain vulnerable to the downside.

On the contrary, should Bitcoin encounter buyers in the area between $102K and $105K, a fresh micro-rally may come into existence, giving the market a much-needed relief. The psychological level of $100K cannot be overemphasized, and any considerable decline below it may lead to an even greater increase in the selling pressure. Consequently, traders and investors will have to monitor these crucial levels closely to get a better idea of the Bitcoin next possible movement.

Final Thoughts

With the rise in the volatility of Bitcoin, the fundamental and technical aspects of the cryptocurrency indicate a potential short-term price change. The Advanced Net UTXO Supply Ratio can be extremely useful in terms of providing marketplace expectations by indicating possible market buying or selling positions. The geo-political situation and liquidity on the market of Bitcoin also threaten future price significantly. As the existing market activity presents the possibility of a consolidation period, investors are recommended to watch the movement of Bitcoin especially within the next few days with a particular focus on the levels of $102K -105K and the break level of $100K.

Follow us on Google News

Get the latest crypto insights and updates.