Bitcoin News Shocker: Metaplanet Buys ¥4B in BTC – Last Chance to Grab Bitcoin Under $80K?

Let’s dive into the latest Bitcoin news as Metaplanet shakes markets with a massive ¥4 billion Bitcoin acquisition that signals rising institutional confidence.

Author by

News Room

Tokyo, April 21, 2025 – The crypto industry experienced a major disruption after Metaplanet Inc. conducted a groundbreaking Bitcoin acquisition of ¥4 billion (~$26 million USD) which expanded its digital asset portfolio by 330 BTC. The announcement which the corporation made in Tokyo at the start of the day on Monday caused immediate aftershocks within the market that continued to command attention across worldwide Bitcoin news platforms.Tokyo’s Metaplanet Inc. Ramps Up Holdings to 4,855 BTC Amid Rising Institutional Confidence

Metaplanet acquired an additional 4,855 bitcoins so it now ranks among the biggest corporate Bitcoin holders across Asia by securing total assets of 4,855 BTC. When Metaplanet made their acquisition the Bitcoin market value for one coin amounted to ¥12,181,570 (~$79,000 USD) indicating institutions saw Bitcoin as a promising long-term investment.

Institutional Momentum Fuels Market Optimism

The global financial sector closely observes as Metaplanet shows its confidence through an institutional Bitcoin resurgence. The Bitcoin price spiked past ¥12.2 million following Metaplanet’s major purchase. Metaplanet adopted this aggressive expansion strategy because the company joins growing institutional investors who view Bitcoin as an essential treasury reserve asset that protects value when economies experience currency debasement and market uncertainties.The Bitcoin price spiked past ¥12.2 million following Metaplanet’s major purchase.This breaking Bitcoin news reaffirms crypto’s growing role in corporate strategy.

MICROSTRATEGY BECOMES A BITCOIN ROCKET WITH $20B FIREPOWER

— Crypto Town Hall (@Crypto_TownHall) April 21, 2025

MicroStrategy (MSTR) has turned into a bitcoin powerhouse, holding 531,644 BTC in its vault.

With @Saylor pushing for broader adoption through ETFs, pensions, and IRAs, MSTR is now a key player in Bitcoin's future.… pic.twitter.com/LVBxKy8FQ5

As per above, MicroStrategy has become a Bitcoin powerhouse with 531,644 BTC and $20B in firepower, as Saylor drives adoption via ETFs, pensions, and IRAs. Institutional investors are reacting swiftly to the Metaplanet-driven Bitcoin news. The latest Metaplanet Bitcoin acquisition has resulted in ¥62.1 billion (~$410 million USD) total investments guided by an average BTC cost of ¥12,804,361. The data-oriented planning strategy of Metaplanet demonstrates its business commitment instead of random speculative bets despite Bitcoin price swings.

Bitcoin Yield KPI: A New Industry Benchmark

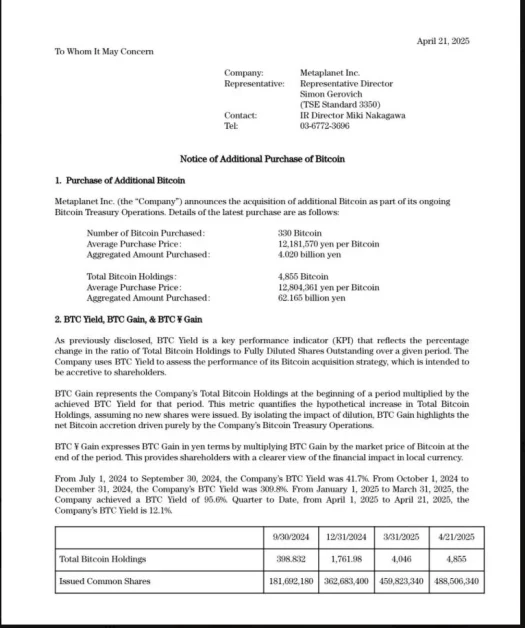

Despite fluctuations, the Bitcoin price remains central to institutional investment decisions. In tandem with the acquisition, Metaplanet also disclosed detailed performance metrics through their proprietary BTC Yield KPI—a key performance indicator evaluating the growth in BTC holdings per share adjusted against fully diluted stock issuance.

Source: X

Experts see the Metaplanet Bitcoin acquisition as a turning point for Asian tech firms. Affirming to the above pasted image, here are some striking figures from the firm’s financial disclosure:

- BTC Yield as of Sep 30, 2024: 41.7%

- BTC Yield as of Dec 31, 2024: 309.8%

- BTC Yield as of Mar 31, 2025: 95.6%

BTC Yield as of Apr 21, 2025: 12.1%

Though the yield percentage has slightly tapered due to share dilution, the underlying growth in holdings remains robust, showcasing how Bitcoin is becoming an increasingly central pillar in Metaplanet’s capital strategy.

Market Reaction & Global Implications

The statement created immediate interest across both conventional financial sectors as well as the cryptocurrency market. The news became a significant milestone for Bitcoin because it proved its ability to serve institutional usage while economic policies face increased assessment from central banks who modify their approaches to inflation management and monetary policy adjustments.

michael saylor is fr a $BTC maximalist… his microstrategy now holds 531,644 bitcoin worth over $46B and he's still buying more. might be last chance to get in before $100k

— Coin captain (@coincaptain22) April 21, 2025

Follow coin captain for more alerts

Michael Saylor’s MicroStrategy now holds 531,644 BTC worth over $46B, reinforcing his stance as a Bitcoin maximalist and continuing to buy more. Metaplanet’s ongoing accumulation shows Japanese corporations that Bitcoin poses a serious strategic value beyond its speculative potential according to crypto expert Hiro Tanaka.

Transparency in the Metaplanet Bitcoin acquisition could lead to industry-wide reporting standards. The Bitcoin price increased rapidly in Asian trading sessions when Japanese exchanges saw boosted volume until it reached the ¥12.2 million range and stabilized.

A Message to Global Corporates?

The action mirrors MicroStrategy’s historical buying pattern and could trigger a fresh period of Bitcoin adoption by tech companies operating in Asia together with listed corporations. Metaplanet’s willingness to publicly disclose complete data about their acquisition metrics creates a new industry standard regarding corporate crypto reporting transparency.

The world is witnessing an increasingly digitized future through decentralized finance governance as Metaplanet demonstrates through its actions. The introduction of institutional Bitcoin strategies across the APAC region remains to be determined but one thing is now certain that institutions are bringing Bitcoin into their portfolios.

News Room

Editor

Newsroom is the editorial team of CoinfoMania, delivering 24/7 crypto news, market insights, and in-depth analysis. With 30+ journalists worldwide, we keep you ahead in the blockchain space.

Read more about News RoomRelated Posts

Pi Network Price Climbs to $1.36 Amid Migration Roadmap Launch and Community Uncertainty

News Room

Editor

Klaus Schwab Steps Down After 55 Years: World Economic Forum Enters New Era

News Room

Editor

Solana Price Prediction: SOL Eyes Breakout Above $142 Resistance in Bullish Trend

News Room

Editor

Loading more news...