In its latest filing, Grayscale, the Bitcoin ETF provider, unveiled details of its new venture, the Bitcoin Mini Trust, which will feature a competitive fee of 0.15%, lower than its predecessor, the GBTC product.

The filing disclosed pro forma financials that also highlight an initial contribution to the mini fund of 63,204 bitcoin, equivalent to 10% of the GBTC’s existing assets. Moreover, shares of the BTC trust will be automatically issued and distributed to existing GBTC shareholders.

These pro forma statements, which project future revenues and expenses, draw from the company’s historical data and anticipated future operations.

Bitcoin ETF Investors Won’t Have To Pay Capital-Gains Taxes On The Migration

Grayscale has launched the Bitcoin Mini Trust to offer GBTC investors a lower-cost alternative aligned with the competitive fees of other Bitcoin ETFs that were approved in January. This initiative provides an economical choice without triggering a capital-gains tax for existing GBTC shareholders, which is a critical factor for early investors who have seen their investments surge by thousands of percentages.

These shareholders can transition to the new fund without incurring the hefty taxes associated with moving to a similar, lower-fee product from competitors.

The original GBTC fund, known for its higher fee structure of 1.5%, has been available for over a decade, initially through private placements. It began publicly trading on an over-the-counter basis in mid-2015. In a significant development, GBTC transitioned to NYSE Arca in January 2024, where it now operates as a spot Bitcoin ETF.

As of now, Grayscale manages approximately $19.6 billion in assets, closely followed by BlackRock’s IBIT fund, which holds just over $17.5 billion. This move underscores Grayscale’s ongoing efforts to stay competitive and attract a broad range of investors by offering more financially accessible investment options.

The Halving Anticipation Turned Bitcoin ETF Inflows Positive Again

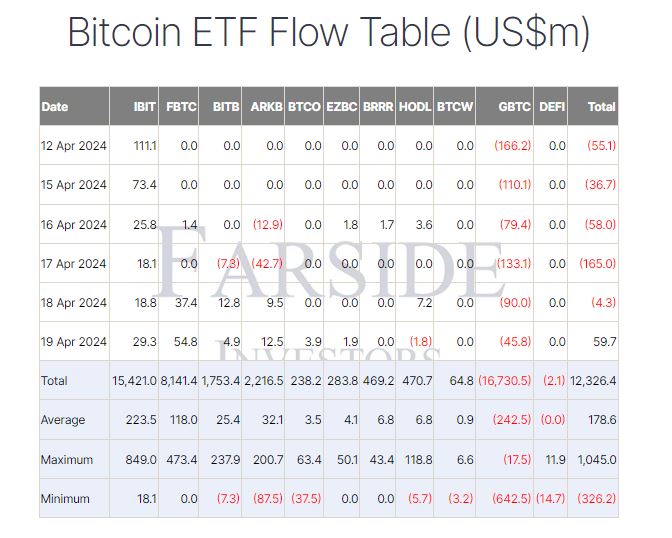

In the United States, Bitcoin ETF investments have turned positive, recording $59.7 million in inflows on April 19, effectively ending a five-day streak of outflows. This resurgence is led by FBTC, which gained $54.8 million, as Farside Investors reported. The uptick in investments comes amidst expectations of a value increase following the Bitcoin halving event.

Significantly, this shift to positive inflows marks a reversal from prior withdrawals, primarily from the Grayscale Bitcoin Trust ETF (GBTC), which occurred after the SEC approved spot Bitcoin ETFs. Other ETFs such as Bitwise Bitcoin ETF (BITB), ARK 21Shares Bitcoin ETF (ARKB), Invesco Galaxy Bitcoin ETF (BTCO), and Franklin Bitcoin ETF (EZBC) also reported notable inflows.

On April 20, the Bitcoin network underwent its fourth-ever halving at block 840,000, which led to a spike in network fees. Users paid 37.7 BTC, equivalent to over $2.4 million, to secure transaction space on this date.

Historically, the previous halving in 2020 propelled Bitcoin’s value from $8,500 to approximately $69,000 within two years. The recent surge in ETF investments reflects a bullish sentiment among investors, anticipating significant growth in Bitcoin’s value following the halving.